Working with Batches of Taxes

Importing and Exporting Tax Rules

See Importing Customers for information on importing customers from a file, including the default tax rules for each customer.

See Exporting Customers for information on exporting customers to a file, including the default tax rules for each customer.

See Exporting Invoices to QuickBooks for information on how taxes on repair invoices and sales invoices are exported to QuickBooks.

Batch Updating of Tax Rules

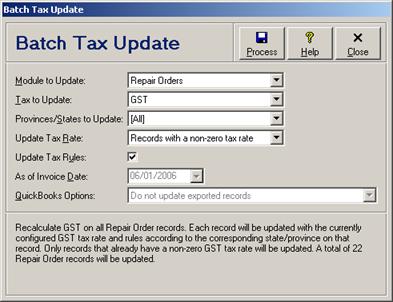

At times, governments introduce a new tax, change a tax rate or tax rules, or discontinue a tax. The batch tax update routine allows multiple records to be quickly updated with the new tax conditions.

First, enter the new tax rules in the Setup Taxes module

(see Editing Default Tax

Categories and Rules). Then, from the customers browse window, repair orders

browse window, sales invoices browse window, or credit notes browse window,

select Batch  Batch Tax Updates

from the main menu to open the batch tax update routine.

Batch Tax Updates

from the main menu to open the batch tax update routine.

The batch tax update routine is available only for licensed users of version 2.5 and higher.

As each tax update option is selected, a word description of which records will be updated is displayed at the bottom of the window. Click the Process button to update the taxes on the selected record group. Click the Close/Cancel button or press the Esc key to quit without processing the tax update. Each of the tax update options is discussed in the following table.

Batch Tax Update Entry Fields

|

Field |

Description |

|

Module to Update |

Select the module in which to updated tax rates and tax rules. Available include Customers, Repair Orders, Repair Invoices, Sales Invoices, and Credit Notes. Repair Orders include all repair order records with a repair order repair status, while Repair Invoices include repair orders with a repair invoice repair status (see Repair Invoice Statuses). If a tax is based on the billing address then the customer accounts should be updated first since they will be referenced for the tax rules. The miscellaneous customer account (i.e. customer account 0000000) will not be updated. Tax updates on sales invoices is not available in the Repair Micro, Retail SQL, and Retail editions. |

|

Tax to Update |

Select whether to update Tax 1, Tax 2, or Tax 3. |

|

Provinces/States to Update |

Select the province or state for which the selected tax should be updated, or select [All] to update taxes on all provinces and states. If the selected tax is based on the billing address and the record being updated is set up for third-party billing, then the province or state in question will be the one from the billing customer account record. Otherwise, the province or state in question will be the one from the shipping address. |

|

Update Tax Rate |

Select No records if tax rates should not be updated on any records, but only tax rules if that option has been selected. Select Records with a non-zero tax rate if tax rates should be updated only on records that have a non-zero tax amount recorded for the selected tax, thereby protecting tax-exempt records (see Tax Exemptions). Select All records if tax rates should be updated on all records. |

|

Update Tax Rules |

Check this box if tax rules should be updated on selected records. Uncheck this box if tax rules should not be updated on selected records, but only tax rates if that option has been selected. |

|

As of Invoice Date |

For repair invoices, sales invoices, and credit notes, enter or select the invoice date starting from which taxes should be updated, or leave empty to update all records. This option is not available for customers or repair orders since they are not date sensitive and all records will always be updated. |

|

QuickBooks Options |

Select Do not update exported records if records that have already been exported to QuickBooks should not have their taxes updated. Select Update exported records and mark to exclude those records if records that have already been exported to QuickBooks should still have their taxes updated, but those record changes are not to be exported again to QuickBooks. Select Update exported records and mark to re-export those records if records that have already been exported to QuickBooks should have their taxes updated, and those records should be marked to automatically export to QuickBooks again. This option is not available in the Repair Lite and Repair Micro editions, or for users who have not yet configured QuickBooks export options (see QuickBooks Export Options). |

Reporting on Taxes

Reporting on Taxes